Tips For Choosing a Weighing Integrator for Packing Operations

Packing operations are always a challenge due to their sheer number of variables. An important part of the process is weighing containers and items for accurate billing or load checking. The method used for this task can profoundly affect accuracy by increasing the impact on productivity and adding extra strain to the operation’s workers. The following article describes a few tips for choosing a weighing integrator that will work effectively in packing operations without disrupting other parts of the process:

- When considering the efficiency of a weighing system, it’s important to keep in mind that the ideal choice balances productivity with technical requirements towards the end-users of the data being collected by it – namely, those who will make use of information on containers of item weight, obtained from the integrator used. Designing systems that provide accurate values without disrupting workers’ pace or workflow is also vital. This is a major advantage that lives load cells have over other types of integrators since they can perform data acquisition without their presence being noticed by other employees.

- When choosing a weighing integrator, its design must align with integration needs, which may be unique depending on whether one is handling products or containers. For instance, if products are typically handled via manual lifting, then integration periods may need to occur periodically throughout the process, whereas with containers, it’ll only happen once when they are loaded/unloaded from the packing station.

- Stability of the integrator is especially important for using cases where containers are being weighed as they can easily slip off unstable surfaces, resulting in damage to either employee, equipment, or both. As such, it’s necessary to select an integrator with fall protection features so that loss of container weight data is avoided even if the integrating surface becomes unstable for any reason.

- When handling containerized products with different weight classes, it is necessary to use an integrator that can accommodate the maximum possible load of all the unit loads (or containers) at any given time, or at least provide a reasonable estimation. Since manually weighing each item might not be practical in some situations, an integrator capable of integrating multiple smaller items into one single countable value during periods where integration is required would be most suitable for the process.

When weighing for packing operations, you need to make sure that the scale and integrator can handle the weight and speed of your load. Furthermore, you should find a familiar system and train your operators accordingly if necessary.…

Get ideas for businesses to start out and for ways to expand your small business with new services. Keeping this thought in mind our next business thought is to offer matchmaker service. Doing this analysis in the beginning of the method is important to keep away from losing time and money on a business idea that flops. This also makes it doable to provide sure providers and content that might otherwise be unavailable to you through Yahoo providers.

Get ideas for businesses to start out and for ways to expand your small business with new services. Keeping this thought in mind our next business thought is to offer matchmaker service. Doing this analysis in the beginning of the method is important to keep away from losing time and money on a business idea that flops. This also makes it doable to provide sure providers and content that might otherwise be unavailable to you through Yahoo providers.

…

… Office cleaning equipment varies on the size of the office and the number of people using the office. Of course, it is unlikely that you will be seeing truck- mounted equipment cleaning a small home or office or a corporate office that caters to hundreds of employees being cleaned with only a broom. Also, the type of equipment used depends on the type of material cleaned. We all know to use a vacuum instead of a mop on carpet. This is a common knowledge even for a non- expert. However, there are some pieces of office cleaning equipment that might be unfamiliar to us. This article discusses some pieces of office cleaning equipment that are often used by professional office cleaners.

Office cleaning equipment varies on the size of the office and the number of people using the office. Of course, it is unlikely that you will be seeing truck- mounted equipment cleaning a small home or office or a corporate office that caters to hundreds of employees being cleaned with only a broom. Also, the type of equipment used depends on the type of material cleaned. We all know to use a vacuum instead of a mop on carpet. This is a common knowledge even for a non- expert. However, there are some pieces of office cleaning equipment that might be unfamiliar to us. This article discusses some pieces of office cleaning equipment that are often used by professional office cleaners. Regarding the ability to fix bad credit, consumers have a very important right found in The Fair Debt Practices Act. Namely, consumers have the right to have a collection account validated.

Regarding the ability to fix bad credit, consumers have a very important right found in The Fair Debt Practices Act. Namely, consumers have the right to have a collection account validated. Order excessive security business checks online from Costco Checks. Just as essential as personalization is the peace of thoughts you may experience realizing that your enterprise checks shall be ordered safely. Choose from excessive security enterprise checks, desk checks, payroll checks and extra in a variety of sizes.

Order excessive security business checks online from Costco Checks. Just as essential as personalization is the peace of thoughts you may experience realizing that your enterprise checks shall be ordered safely. Choose from excessive security enterprise checks, desk checks, payroll checks and extra in a variety of sizes.

When it comes to your own home then you probably have no problem at all with keeping it clean and tidy. In fact you probably more or less have a routine as to what you clean and when you do it. This works well for most people. However when it comes to your office or work premises this is a different matter altogether. For starters the place that you work is likely to be much larger than your home which makes cleaning it a much a harder task. As it is larger it will take longer to do. You are likely to be busy during working hours and so don’t want to take time out of your busy schedule in order to have to clean up your office.

When it comes to your own home then you probably have no problem at all with keeping it clean and tidy. In fact you probably more or less have a routine as to what you clean and when you do it. This works well for most people. However when it comes to your office or work premises this is a different matter altogether. For starters the place that you work is likely to be much larger than your home which makes cleaning it a much a harder task. As it is larger it will take longer to do. You are likely to be busy during working hours and so don’t want to take time out of your busy schedule in order to have to clean up your office..jpg) Your credit report is a record of past borrowing and repayment. It includes information regarding any late repayments you have ever made, and whether you have been declared bankrupt in the past. A financial institution such as a bank will review your credit report if you approach them for a loan or credit card, to assess the risks involved in lending you money. A credit report indicating you are good at making repayments on time and have not been bankrupt is likely to encourage the bank to lend you money, at a low rate. However, if your report shows a poor credit history, they will lend money at a higher rate — or may refuse to lend you money at all.

Your credit report is a record of past borrowing and repayment. It includes information regarding any late repayments you have ever made, and whether you have been declared bankrupt in the past. A financial institution such as a bank will review your credit report if you approach them for a loan or credit card, to assess the risks involved in lending you money. A credit report indicating you are good at making repayments on time and have not been bankrupt is likely to encourage the bank to lend you money, at a low rate. However, if your report shows a poor credit history, they will lend money at a higher rate — or may refuse to lend you money at all. When it comes to doing a refinancing home loan, consumers can make their mortgage process a bit easier by avoiding 3 major mistakes that borrowers frequently make and will ultimately prevent them from getting their desirable mortgage.

When it comes to doing a refinancing home loan, consumers can make their mortgage process a bit easier by avoiding 3 major mistakes that borrowers frequently make and will ultimately prevent them from getting their desirable mortgage. Get ideas for companies to start out and for tactics to broaden your small business with new services. Beginning good antique store is next business concept. Many of these concepts carry low startup prices and will be run from residence. Listed below are 50 business ideas for teenagers to think about. Should you have a knack for connecting with individuals and the willingness to take on some threat, a fee-based mostly freelance gross sales role might be a fantastic side enterprise thought for you.

Get ideas for companies to start out and for tactics to broaden your small business with new services. Beginning good antique store is next business concept. Many of these concepts carry low startup prices and will be run from residence. Listed below are 50 business ideas for teenagers to think about. Should you have a knack for connecting with individuals and the willingness to take on some threat, a fee-based mostly freelance gross sales role might be a fantastic side enterprise thought for you.

A practical person makes sure that he insures things he invests in. If he owns a sail boat, the smart move for him is to get sail boat insurance to protect it from damage or loss. No one knows what can happen in the future.

A practical person makes sure that he insures things he invests in. If he owns a sail boat, the smart move for him is to get sail boat insurance to protect it from damage or loss. No one knows what can happen in the future. When it comes to the rather challenging topic of personal finance budgeting, many of us will look for a helping hand to give us that all essential nudge in the right direction and to that effect then, personal finance software can often prove to be a fairly helpful ally in that regard. Sadly, budgeting is and can be a very difficult thing to achieve indeed and as such, this software can help eliminate the dangers of errors tainting the accuracy of results. Now that we have identified just why this software is so important, let us now consider what factors we should look for when choosing between different candidates.

When it comes to the rather challenging topic of personal finance budgeting, many of us will look for a helping hand to give us that all essential nudge in the right direction and to that effect then, personal finance software can often prove to be a fairly helpful ally in that regard. Sadly, budgeting is and can be a very difficult thing to achieve indeed and as such, this software can help eliminate the dangers of errors tainting the accuracy of results. Now that we have identified just why this software is so important, let us now consider what factors we should look for when choosing between different candidates. Get concepts for companies to start out and for tactics to expand your small business with new products and services. Should you’ve developed priceless talent units or certifications within your business over time, think about putting your abilities to make use of in your free time by providing your consulting services to local business owners as a doubtlessly lucrative side enterprise concept.

Get concepts for companies to start out and for tactics to expand your small business with new products and services. Should you’ve developed priceless talent units or certifications within your business over time, think about putting your abilities to make use of in your free time by providing your consulting services to local business owners as a doubtlessly lucrative side enterprise concept.

…

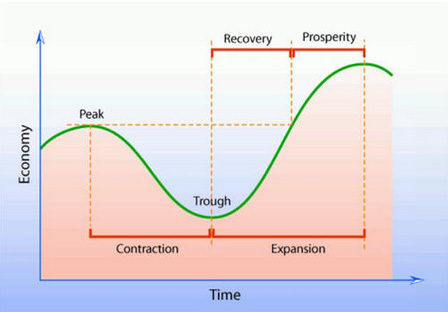

… A good investor always knows where money goes and where to invest it. And that is an essential quality, especially nowadays when economy is so sensitive and unpredictable. The crisis that struck worldwide proved that in order to be successful in business you must make safe investments and follow attentively the market tendencies. The causes which led to the recent recession must also be studied and taken into account, lest they should occur again and cause even more devastating effects.

A good investor always knows where money goes and where to invest it. And that is an essential quality, especially nowadays when economy is so sensitive and unpredictable. The crisis that struck worldwide proved that in order to be successful in business you must make safe investments and follow attentively the market tendencies. The causes which led to the recent recession must also be studied and taken into account, lest they should occur again and cause even more devastating effects. When we think about an office, we think about desks, computers and lots of papers. Depending on the type of business, we can think about other types of equipment also, but, no matter what your business is about, the truth is that there are many documents that cannot be kept just electronically; we need a printed copy for our files. The paper-less culture is still at large, and we still need to handle lots of papers around the office.

When we think about an office, we think about desks, computers and lots of papers. Depending on the type of business, we can think about other types of equipment also, but, no matter what your business is about, the truth is that there are many documents that cannot be kept just electronically; we need a printed copy for our files. The paper-less culture is still at large, and we still need to handle lots of papers around the office. Did you know you possibly can refine a search by telling Yahoo to search for sure varieties of content? Select from over 3500 check merchandise. You can get probably the most skilled Basic Guide Enterprise Checks 10% Low cost Promo: 16950. Order customized business checks online from Deluxe with FREE transport. Make your private finances more enjoyable with customized checks.

Did you know you possibly can refine a search by telling Yahoo to search for sure varieties of content? Select from over 3500 check merchandise. You can get probably the most skilled Basic Guide Enterprise Checks 10% Low cost Promo: 16950. Order customized business checks online from Deluxe with FREE transport. Make your private finances more enjoyable with customized checks.

What are the factors contributing to the success of the financial service and banking sector?

What are the factors contributing to the success of the financial service and banking sector? Many people who face financial difficulties are in their current state because their credit card debt is spiraling out of control. This happens to millions of people every year – an unexpected situation arises such as car repairs or medical costs, they don’t have the savings to cover it and they use a credit card to pay the bill.

Many people who face financial difficulties are in their current state because their credit card debt is spiraling out of control. This happens to millions of people every year – an unexpected situation arises such as car repairs or medical costs, they don’t have the savings to cover it and they use a credit card to pay the bill.

…

… A lawsuit loan can be a wonderful tool to help you get the justice you are seeking. Unfortunately, lawsuits can be expensive, and when you have already been harmed, this can add a great deal of insult to injury. To stay on top of legal bills, medical bills, and all of the other common daily living expenses, money can become extremely tight, or non-existent. This type of a loan can keep repossession, foreclosure, and even bankruptcy at bay.

A lawsuit loan can be a wonderful tool to help you get the justice you are seeking. Unfortunately, lawsuits can be expensive, and when you have already been harmed, this can add a great deal of insult to injury. To stay on top of legal bills, medical bills, and all of the other common daily living expenses, money can become extremely tight, or non-existent. This type of a loan can keep repossession, foreclosure, and even bankruptcy at bay. One of the biggest enemies of productivity is a cluttered space. While the rare few might work better in such an environment, chances are you aren’t one of them (even if you think you are). Organization and cleanliness is an important aspect of getting work done efficiently. That’s why the concept of office cleaning is so vital. Not only for the workplace, but also for the home, if you do work of any kind at your house. Here are some tips to getting things tidied up.

One of the biggest enemies of productivity is a cluttered space. While the rare few might work better in such an environment, chances are you aren’t one of them (even if you think you are). Organization and cleanliness is an important aspect of getting work done efficiently. That’s why the concept of office cleaning is so vital. Not only for the workplace, but also for the home, if you do work of any kind at your house. Here are some tips to getting things tidied up. 20 Small Business Ideas in the Philippines for 2018 Manny January 08, 2018 241 Feedback Making a living within the Philippines may be onerous in case you are solely looking in one direction, and that’s, employment. Then, do not worry about it. These 50 small enterprise ideas in india video lets you discover out one of the best small enterprise in your native space. Tease ideas out of people that’re unwilling to be creative with their time. There is a growing demand for any such service and all you really need to do is begin networking and create menu plans that you could repeat for various clients.

20 Small Business Ideas in the Philippines for 2018 Manny January 08, 2018 241 Feedback Making a living within the Philippines may be onerous in case you are solely looking in one direction, and that’s, employment. Then, do not worry about it. These 50 small enterprise ideas in india video lets you discover out one of the best small enterprise in your native space. Tease ideas out of people that’re unwilling to be creative with their time. There is a growing demand for any such service and all you really need to do is begin networking and create menu plans that you could repeat for various clients.

Any motorist needs to get a car insurance policy and they are most likely going to want to get the best rates possible. With a little bit of time and effort there is no reason why you shouldn’t be able to save a great deal of money when you next purchase a policy. Here are some basic tips that may prove useful.

Any motorist needs to get a car insurance policy and they are most likely going to want to get the best rates possible. With a little bit of time and effort there is no reason why you shouldn’t be able to save a great deal of money when you next purchase a policy. Here are some basic tips that may prove useful. There are some companies offering office cleaning in Glasgow and promoting that they are able to deliver a premium service at a vastly reduced price. The price being quoted is for A�8 per hour.

There are some companies offering office cleaning in Glasgow and promoting that they are able to deliver a premium service at a vastly reduced price. The price being quoted is for A�8 per hour. Planning a budget is one of the simplest and most effective ways of managing your money. However, most individuals avoid actually taking the time to do it because it take time and a little bit of effort. Many also believe that budgeting their money will prevent them from being able to do the fun activities they enjoy.

Planning a budget is one of the simplest and most effective ways of managing your money. However, most individuals avoid actually taking the time to do it because it take time and a little bit of effort. Many also believe that budgeting their money will prevent them from being able to do the fun activities they enjoy. Simply order and re-order private and business checks using Vistaprint’s safe encryption platform. If you must manage multiple accounts or control cash management by not having massive portions of preprinted checks, presents great values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, 3 per web page blank laser checks, and clean laser voucher 2 checks per page products.

Simply order and re-order private and business checks using Vistaprint’s safe encryption platform. If you must manage multiple accounts or control cash management by not having massive portions of preprinted checks, presents great values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, 3 per web page blank laser checks, and clean laser voucher 2 checks per page products.

If you plan to open an office cleaning company, you will soon find out that it can be a profitable home-based business. Many businesses prefer to hire the services of a cleaning company than paying a janitor full wage and benefits. It is actually more economical for offices to get independent cleaners.

If you plan to open an office cleaning company, you will soon find out that it can be a profitable home-based business. Many businesses prefer to hire the services of a cleaning company than paying a janitor full wage and benefits. It is actually more economical for offices to get independent cleaners. Finally, winter has passed and it’s time for the much needed spring cleaning!

Finally, winter has passed and it’s time for the much needed spring cleaning! 20 Small Enterprise Concepts within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines may be laborious if you are solely looking in one route, and that’s, employment. Use Lindy’s Legislation to figure out where it’s applicable to spend your time studying and why. Driving for one of many two globally expanding app-centric taxi alternative providers, Uber or Lyft can still be a reasonably profitable option to earn money as a side business idea on nights and weekends—working only whenever you need.

20 Small Enterprise Concepts within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines may be laborious if you are solely looking in one route, and that’s, employment. Use Lindy’s Legislation to figure out where it’s applicable to spend your time studying and why. Driving for one of many two globally expanding app-centric taxi alternative providers, Uber or Lyft can still be a reasonably profitable option to earn money as a side business idea on nights and weekends—working only whenever you need.

You can find affordable motorcycle insurance quotes. You just need to know where to look. The interesting thing about these quotes is that these are everywhere and it makes it easier for you to budget your money in such a way that will allow you to actually get the motorbike insurance that you have long been looking for.

You can find affordable motorcycle insurance quotes. You just need to know where to look. The interesting thing about these quotes is that these are everywhere and it makes it easier for you to budget your money in such a way that will allow you to actually get the motorbike insurance that you have long been looking for. When using credit cards or store cards, chances are, the user incurs mounting interests on these cards on top of their debts. That is why, while convenience is tops when using these plastic cards, chances are they ultimately ruin the life of the user just because it leaves him piled up in debts.

When using credit cards or store cards, chances are, the user incurs mounting interests on these cards on top of their debts. That is why, while convenience is tops when using these plastic cards, chances are they ultimately ruin the life of the user just because it leaves him piled up in debts. Take Cost of Your Enterprise with a Free Enterprise Checking Account from Centier. Get enterprise checks quick and save seventy five % off financial institution costs. Checks can also be ordered by calling Member Providers at 407.277.5045 or visiting any department location. Business checks by CheckWorks. Select from high security checks, proprietor, itemized invoice, twin objective and payroll checks.

Take Cost of Your Enterprise with a Free Enterprise Checking Account from Centier. Get enterprise checks quick and save seventy five % off financial institution costs. Checks can also be ordered by calling Member Providers at 407.277.5045 or visiting any department location. Business checks by CheckWorks. Select from high security checks, proprietor, itemized invoice, twin objective and payroll checks. Most of us probably have the notion that cleaning is all about stacking the files, managing the bills, and removing dust from the table. But, as we have grown to the levels of sophistication in our workplace and thus, the level of cleaning has grown to a higher level too. A clean workplace incurs a healthy environment to work on, and thus proves to be beneficial for your business. Most of the time, we don’t consider this clause in our business strategies. Cleaning at your workplace is like salt in your dish, no one will notice the presence, but its absence won’t be neglected for sure.

Most of us probably have the notion that cleaning is all about stacking the files, managing the bills, and removing dust from the table. But, as we have grown to the levels of sophistication in our workplace and thus, the level of cleaning has grown to a higher level too. A clean workplace incurs a healthy environment to work on, and thus proves to be beneficial for your business. Most of the time, we don’t consider this clause in our business strategies. Cleaning at your workplace is like salt in your dish, no one will notice the presence, but its absence won’t be neglected for sure. The prospect of traveling, whether within the country or abroad, can be very exciting. There are so many places to go and things to do! It’s a little easy to get carried away with planning events and there may be a need to adjust the budget a time or two accordingly. When preparing for travel, it is wise to keep in mind ways to keep the costs down. There are many ways to decrease expenses and have a pleasant trip.

The prospect of traveling, whether within the country or abroad, can be very exciting. There are so many places to go and things to do! It’s a little easy to get carried away with planning events and there may be a need to adjust the budget a time or two accordingly. When preparing for travel, it is wise to keep in mind ways to keep the costs down. There are many ways to decrease expenses and have a pleasant trip. Select from over 3500 verify merchandise. Our Common Enterprise Checking Account is ideal for the growing business with moderate exercise. Yahoo strives to connect you with the merchandise, providers, and companies you are looking for. Choose your Business Checks by Design. Study extra about Deluxe advertising and marketing services and checks here.

Select from over 3500 verify merchandise. Our Common Enterprise Checking Account is ideal for the growing business with moderate exercise. Yahoo strives to connect you with the merchandise, providers, and companies you are looking for. Choose your Business Checks by Design. Study extra about Deluxe advertising and marketing services and checks here.

Bob Proctor first explained The Vacuum Law of Prosperity to me by telling the story of his Aunt Marge, who told him she hated her curtains. Taking the risk of offending her, he told her that she was really quite happy with her curtains and when she asked how he could say that, he explained that if she really no longer “resonated” with her curtains she would have gotten rid of them long before. Then he explained The Vacuum Law of Prosperity to her as well. He coached her by having her give away the curtains she no longer wanted and that by law she would get the curtains she loved. She objected by complaining that she did not have the money for new curtains. He responded by saying, “just give the old curtains away and you will be surprised by what will happen.” The next time Bob went to visit his aunt; she happily showed him her new curtains. The Vacuum Law of Prosperity really works.

Bob Proctor first explained The Vacuum Law of Prosperity to me by telling the story of his Aunt Marge, who told him she hated her curtains. Taking the risk of offending her, he told her that she was really quite happy with her curtains and when she asked how he could say that, he explained that if she really no longer “resonated” with her curtains she would have gotten rid of them long before. Then he explained The Vacuum Law of Prosperity to her as well. He coached her by having her give away the curtains she no longer wanted and that by law she would get the curtains she loved. She objected by complaining that she did not have the money for new curtains. He responded by saying, “just give the old curtains away and you will be surprised by what will happen.” The next time Bob went to visit his aunt; she happily showed him her new curtains. The Vacuum Law of Prosperity really works. In the world of finance, time is money. Maybe the past 10 years have been a failure when it comes to managing money. How to make up for lost time?

In the world of finance, time is money. Maybe the past 10 years have been a failure when it comes to managing money. How to make up for lost time? When selecting a business concept, focus in your strengths and abilities. In the event you don’t mind doing different folks’s chores, then TaskRabbit could be the right facet business thought for you. In case you are able to turn into a web based business proprietor, I’ve obtained 17 on-line enterprise ideas that will help you get off the ground and on the best way to making money online.

When selecting a business concept, focus in your strengths and abilities. In the event you don’t mind doing different folks’s chores, then TaskRabbit could be the right facet business thought for you. In case you are able to turn into a web based business proprietor, I’ve obtained 17 on-line enterprise ideas that will help you get off the ground and on the best way to making money online.

…

… Cleanliness is not the prime issue that may matter to your business, but nonetheless it cannot be ignored as well. What you need is a service that provides faultless cleaning everyday. Hiring professional cleaning services would relieve you of the cleaning problems of any kind, along with saving money as well. Read on for more information.

Cleanliness is not the prime issue that may matter to your business, but nonetheless it cannot be ignored as well. What you need is a service that provides faultless cleaning everyday. Hiring professional cleaning services would relieve you of the cleaning problems of any kind, along with saving money as well. Read on for more information. When hiring a commercial cleaning contractor, it is imperative to choose a green company for the health of your office environment. The office cleaning services you select should use only the highest quality ingredients in their cleaning products.

When hiring a commercial cleaning contractor, it is imperative to choose a green company for the health of your office environment. The office cleaning services you select should use only the highest quality ingredients in their cleaning products. Harland Clarke offers personal and enterprise checks and check-associated products. Order checks online or call 708-613-2452. Simply order personal checks, business checks, federal tax types, return tackle labels, self inking stamps, envelopes, and more from Costco Checks online. For those who depend on the pc for bookkeeping and accounting, having a supply of Laptop Checks is a must.

Harland Clarke offers personal and enterprise checks and check-associated products. Order checks online or call 708-613-2452. Simply order personal checks, business checks, federal tax types, return tackle labels, self inking stamps, envelopes, and more from Costco Checks online. For those who depend on the pc for bookkeeping and accounting, having a supply of Laptop Checks is a must.

…

… If you’re setting up an office, or are always running out of stationery, then you’ll want to make sure that you have all the office supplies you and your staff need to keep your company going.

If you’re setting up an office, or are always running out of stationery, then you’ll want to make sure that you have all the office supplies you and your staff need to keep your company going. Begin an internet business right this moment! The most definitely purchasers for a personal concierge service are top executives who discover themselves on the workplace by 7 a.m. and are there most nights till 9 p.m., leaving them little or no time to do all those things that always have to be performed during those very hours.

Begin an internet business right this moment! The most definitely purchasers for a personal concierge service are top executives who discover themselves on the workplace by 7 a.m. and are there most nights till 9 p.m., leaving them little or no time to do all those things that always have to be performed during those very hours.