How Office Cleaning Contributes to Create Green Environment?

How Office Cleaning Contributes to Create Green Environment?

Office cleaning is not just about aesthetics. It’s about organizations waking up to their corporate responsibility and keeping a green environment. More organizations have embraced the use of green products to clean their offices and create a good environment for their staff as well as their clients and customers.

Office cleaning is not just about aesthetics. It’s about organizations waking up to their corporate responsibility and keeping a green environment. More organizations have embraced the use of green products to clean their offices and create a good environment for their staff as well as their clients and customers.

Green cleaning involves the use of cleaning techniques and products that cannot harm people or the environment. A major feature of using green products for cleaning offices is the low percentage of volatile organic compounds. The products are for the most-part biodegradable; they go back into the eco-system easily and harmlessly after use.

Secondly, products that are soluble in water play a major role in maintaining a clean and green environment at the office. They go hand in hand with dilution systems that control the amount of chemicals that are used in cleaning. Dilution systems make sure the environment is safe from the unnecessary and excessive presence of hazardous substances.

One green cleaning technique for the office may includes the use of cloths and mops made of microfiber. These light products help absorb dust with minimal or no water needed. This green methods ensures the proper use of water resources.

Organizations may use matting systems to absorb dust at external doors and cut the rate of wear and tear of the entire establishment. Some modern buildings use track-off systems at their entrances to keep a clean interior environment. In order to decrease harm to the office environment, office workers should decrease the amount of dirt allowed into it. Preventive measures help to keep a clean environment.

In addition, reducing the use of paper in the workplace contributes towards a greener environment. Some offices use paper dispensers that check wasteful use. Packaging cleaning chemicals in recyclable material also goes along way. Another approach involves purchasing items in bulk to cut down on waste.

Effective office cleaners address the issue of aeration and air quality in a building. The presence of toxic materials and substances in the office may compromise the overall air quality. As such, green cleaning emphasizes the flow of fresh air into the office as toxins flow out through appropriately installed ventilation systems.

Today, almost everything is outsourced. Cleaning services for offices come from a trusted and professional cleaning services companies. Use companies that offer top-notch and customized office cleaning services to their customers and support high standards in service delivery. Having played your role, you may focus on core-business of your firm.…

20 Small Enterprise Ideas within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines could be exhausting in case you are only looking in one direction, and that’s, employment. You can begin by signing up on freelancing sites such as Upwork to check the waters with this enterprise thought first. Ladies-owned businesses are on the rise and there has never been a greater time to begin one. Open Share advertising trading agency and provide brokerage companies to finish-consumer.

20 Small Enterprise Ideas within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines could be exhausting in case you are only looking in one direction, and that’s, employment. You can begin by signing up on freelancing sites such as Upwork to check the waters with this enterprise thought first. Ladies-owned businesses are on the rise and there has never been a greater time to begin one. Open Share advertising trading agency and provide brokerage companies to finish-consumer.

.jpg) If you’re struggling with debt, changes are good you probably aren’t tithing. You probably just don’t know how you could possibly come up with another 10 percent when you are already broke and living paycheck to paycheck in order to tithe. You are probably wondering how you are just going to pay the rent and feed your family this month, so tithing is out of the question. Am I right? I know because I’ve been there. But, what I can tell you without a shadow of a doubt is that tithing is part of the Christian’s walk of faith, and tithing is the cornerstone of Christian finance.

If you’re struggling with debt, changes are good you probably aren’t tithing. You probably just don’t know how you could possibly come up with another 10 percent when you are already broke and living paycheck to paycheck in order to tithe. You are probably wondering how you are just going to pay the rent and feed your family this month, so tithing is out of the question. Am I right? I know because I’ve been there. But, what I can tell you without a shadow of a doubt is that tithing is part of the Christian’s walk of faith, and tithing is the cornerstone of Christian finance. Offices always need to be maintained in top order for creating the right impression and also to provide hygienically safe environment for all the staff. If you own an office of your own and want to hire reliable services to clean your office then help is not far away. You can search in the internet for commercial cleaning services.

Offices always need to be maintained in top order for creating the right impression and also to provide hygienically safe environment for all the staff. If you own an office of your own and want to hire reliable services to clean your office then help is not far away. You can search in the internet for commercial cleaning services. 20 Small Business Ideas within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a residing within the Philippines may be onerous if you’re only trying in a single course, and that’s, employment. It will possibly have a large amount of time funding to get things up and operating however will be extra rewarding than some other type of enterprise, at Reside Giggle Love Ladies Club we will give you every part you need through our Business Opportunity page that can best describe what you will get in terms of assist and what’s included in your starter pack.

20 Small Business Ideas within the Philippines for 2018 Manny January 08, 2018 241 Comments Making a residing within the Philippines may be onerous if you’re only trying in a single course, and that’s, employment. It will possibly have a large amount of time funding to get things up and operating however will be extra rewarding than some other type of enterprise, at Reside Giggle Love Ladies Club we will give you every part you need through our Business Opportunity page that can best describe what you will get in terms of assist and what’s included in your starter pack.

Office cleaning services do much more than simply empty the wastebaskets or wash the windows. In fact, there are several cases that have been documented which prove that regular vacuuming and cleaning of an office can significantly reduce “sick time” taken by employees and actually increase productivity. By taking these elements into account, most companies can actually offset the cost of office cleaning through their insurance provider or via their taxes, making it an essential ingredient for any successful organization.

Office cleaning services do much more than simply empty the wastebaskets or wash the windows. In fact, there are several cases that have been documented which prove that regular vacuuming and cleaning of an office can significantly reduce “sick time” taken by employees and actually increase productivity. By taking these elements into account, most companies can actually offset the cost of office cleaning through their insurance provider or via their taxes, making it an essential ingredient for any successful organization. The UK commercial cleaning market has become ever so competitive with hundreds, maybe thousands of cleaning companies operating throughout the land. Proof to that is by doing a simple search on Google maps for office cleaning services in central London and you get hundreds of results. So how to determine which one is the most efficient out of them all?

The UK commercial cleaning market has become ever so competitive with hundreds, maybe thousands of cleaning companies operating throughout the land. Proof to that is by doing a simple search on Google maps for office cleaning services in central London and you get hundreds of results. So how to determine which one is the most efficient out of them all? Discover and save concepts about Business concepts on Pinterest. For those who’re the type to hit all the local storage sales each weekend, there’s all sorts of useful issues that can be resold on-line as a aspect enterprise thought. In case you are planning to begin a business within the metro metropolis, offering planning service for a celebration is a good enterprise thought.

Discover and save concepts about Business concepts on Pinterest. For those who’re the type to hit all the local storage sales each weekend, there’s all sorts of useful issues that can be resold on-line as a aspect enterprise thought. In case you are planning to begin a business within the metro metropolis, offering planning service for a celebration is a good enterprise thought.

Office Cleaning is much more difficult than you can possibly imagine. You may not be emotionally attached to the cleaning and caring of the premises like in your own house, but you have to give a lot of attention to the other details because it reflects your personality and more importantly, will go a long way to reflect your ethics to your employees and your delegates. Therefore, you should choose office cleaners who will pay attention to their work and you do not have to go around looking whether they are doing their job properly, leaving your own, and work that is far more important. Here are some things that you should settle with the cleaners before you appoint them.

Office Cleaning is much more difficult than you can possibly imagine. You may not be emotionally attached to the cleaning and caring of the premises like in your own house, but you have to give a lot of attention to the other details because it reflects your personality and more importantly, will go a long way to reflect your ethics to your employees and your delegates. Therefore, you should choose office cleaners who will pay attention to their work and you do not have to go around looking whether they are doing their job properly, leaving your own, and work that is far more important. Here are some things that you should settle with the cleaners before you appoint them. Around the world, one can find quality and business-oriented cleaning companies. Cleaning is no longer considered a household or office chore but has now developed into a fully-fledged industry. This industry is now important for many customers across different continents.

Around the world, one can find quality and business-oriented cleaning companies. Cleaning is no longer considered a household or office chore but has now developed into a fully-fledged industry. This industry is now important for many customers across different continents. Discover and save ideas about Enterprise ideas on Pinterest. The most probably clients for a personal concierge service are high executives who find themselves on the office by 7 a.m. and are there most nights until 9 p.m., leaving them little or no time to do all these things that usually must be done during those very hours.

Discover and save ideas about Enterprise ideas on Pinterest. The most probably clients for a personal concierge service are high executives who find themselves on the office by 7 a.m. and are there most nights until 9 p.m., leaving them little or no time to do all these things that usually must be done during those very hours.

.jpg/220px-Women's_suit_(2).jpg) The first thing you have to do is have a real desire to change your life.A� Once you have that, you can begin learning about real estate investment.A� Always be open to advise, from friends, acquaintances and even experts.A� You never know what kind of quality advice you will receive or what type of information you can use for your own personal investing.A� Most people have either invested in real estate or are planning to and when people are interested in the market, they learn a lot, whether it is beneficial or a disaster.A�

The first thing you have to do is have a real desire to change your life.A� Once you have that, you can begin learning about real estate investment.A� Always be open to advise, from friends, acquaintances and even experts.A� You never know what kind of quality advice you will receive or what type of information you can use for your own personal investing.A� Most people have either invested in real estate or are planning to and when people are interested in the market, they learn a lot, whether it is beneficial or a disaster.A� When it comes to cleaning the home or office there is a lot of office cleaning supplies that can meet the demands that you have. Taski is the maker of a large variety of floor cleaning products that can be used either in the workplace or in the home.

When it comes to cleaning the home or office there is a lot of office cleaning supplies that can meet the demands that you have. Taski is the maker of a large variety of floor cleaning products that can be used either in the workplace or in the home. When selecting a enterprise concept, focus on your strengths and skills. Each ideas will take hard work and several other years to take off, which makes them interesting as you maintain down your current full-time place. A popular industry that girls are becoming increasingly more concerned in is software program improvement, you probably have an idea for a bit of software program or a cellular app then why not learn to create it and profit out of your creativity.

When selecting a enterprise concept, focus on your strengths and skills. Each ideas will take hard work and several other years to take off, which makes them interesting as you maintain down your current full-time place. A popular industry that girls are becoming increasingly more concerned in is software program improvement, you probably have an idea for a bit of software program or a cellular app then why not learn to create it and profit out of your creativity.

Imagine this — you come in to work on a Monday morning and set your briefcase down. You swat at a few flies, causing you to realize that you forgot to empty your desk’s trash can before you left on Friday. You look around, and you see a lot of other very full-looking trash cans. Before you can get disgusted, you feel your nose start to twitch, and you erupt in a sneezing fit thanks to the dust that’s accumulated over the past few weeks. If you think this type of work environment isn’t conducive to quality, professional work, you’re right.

Imagine this — you come in to work on a Monday morning and set your briefcase down. You swat at a few flies, causing you to realize that you forgot to empty your desk’s trash can before you left on Friday. You look around, and you see a lot of other very full-looking trash cans. Before you can get disgusted, you feel your nose start to twitch, and you erupt in a sneezing fit thanks to the dust that’s accumulated over the past few weeks. If you think this type of work environment isn’t conducive to quality, professional work, you’re right. You’re there. You have made the decision. You’re committed. You have timelines now. We’re talking about your franchise finance decision and the next challenge you have in the franchise process – financing a franchise. How many ways to finance a franchise are there? Only one… the right way! And we’ll show you how.

You’re there. You have made the decision. You’re committed. You have timelines now. We’re talking about your franchise finance decision and the next challenge you have in the franchise process – financing a franchise. How many ways to finance a franchise are there? Only one… the right way! And we’ll show you how. When selecting a business idea, focus in your strengths and abilities. When you spot a niche that hasn’t been filled to its potential simply yet, and you may be taught the coding abilities (or know someone who already has them), you could possibly be on to one thing with this side business idea. Editor’s be aware: These ideas are supposed to function inspiration, and usually are not supposed to be an alternative to due diligence and skilled business teaching advice.

When selecting a business idea, focus in your strengths and abilities. When you spot a niche that hasn’t been filled to its potential simply yet, and you may be taught the coding abilities (or know someone who already has them), you could possibly be on to one thing with this side business idea. Editor’s be aware: These ideas are supposed to function inspiration, and usually are not supposed to be an alternative to due diligence and skilled business teaching advice.

.jpg/220px-NYU_Stern_School_of_Business_-_Henry_Kaufman_Management_Center_(48072761732).jpg) Cleaning service is an institution since 1988. It specializes in cleaning household and commercial establishments. Nowadays, in all sorts of place in the US, there have been several companies that are engaging in services like this.

Cleaning service is an institution since 1988. It specializes in cleaning household and commercial establishments. Nowadays, in all sorts of place in the US, there have been several companies that are engaging in services like this. Keeping the office clean and organized is quite essential to keep the motivations of employees high. Besides,keeping a clean office is the basic business requirement and no firm compromises on it. So, if you have recently set up an office and you wish to hire a genuine office-cleaning agency then you must judge it on the basis of following important parameters.

Keeping the office clean and organized is quite essential to keep the motivations of employees high. Besides,keeping a clean office is the basic business requirement and no firm compromises on it. So, if you have recently set up an office and you wish to hire a genuine office-cleaning agency then you must judge it on the basis of following important parameters. There are many aspects to consider when aiming to achieve a harmonious work environment. Of course there are obvious elements such cleanliness, practical efficiency and style but what about things like furniture arrangement and feng shui? There are some commercial cleaning companies that offer services such as these. So be a selective and discerning client and seek out help from professionals to ensure you get the most out of your cleaning company and achieve the best results for your work place.

There are many aspects to consider when aiming to achieve a harmonious work environment. Of course there are obvious elements such cleanliness, practical efficiency and style but what about things like furniture arrangement and feng shui? There are some commercial cleaning companies that offer services such as these. So be a selective and discerning client and seek out help from professionals to ensure you get the most out of your cleaning company and achieve the best results for your work place. No matter how rewarding your full-time job may be, discovering the precise side business ideas and finally becoming totally self-employed is much more meaningful than great pay and strong benefits. Internet or app design and development is one other field that is turning into more and more vital for companies, as they give the impression of being to enhance the expertise of their clients. Supply your prospects an ala carte menu of providers, from helping pick flowers, the marriage gown and bridesmaid attire to picking the venue and hiring the caterer.

No matter how rewarding your full-time job may be, discovering the precise side business ideas and finally becoming totally self-employed is much more meaningful than great pay and strong benefits. Internet or app design and development is one other field that is turning into more and more vital for companies, as they give the impression of being to enhance the expertise of their clients. Supply your prospects an ala carte menu of providers, from helping pick flowers, the marriage gown and bridesmaid attire to picking the venue and hiring the caterer.

Do you know you may refine a search by telling Yahoo to look for sure varieties of content? Manual checks are convenient easy to make use of and come in a variety of types. Save money on your Deluxe checks, and get the very best quality there may be. All of our customer support representatives practice for 200 hours on our laser check merchandise and order entry system, giving them a complete understanding of what we offer and methods to reply questions of our clients.

Do you know you may refine a search by telling Yahoo to look for sure varieties of content? Manual checks are convenient easy to make use of and come in a variety of types. Save money on your Deluxe checks, and get the very best quality there may be. All of our customer support representatives practice for 200 hours on our laser check merchandise and order entry system, giving them a complete understanding of what we offer and methods to reply questions of our clients.

If you want to impress visitors and customers, having a well maintained office area is essential. Office space that is clean and tidy helps establish a positive image of the company. Imagine walking into an office that is filthy, disorganized and cluttered. First impression is crucial to creating that image of quality and professionalism. That is why it is important to employee a professional service to maintain the aesthetic qualities of your company. Competent companies that specialize in office cleaning services to fill the needs of your company are easy to find.

If you want to impress visitors and customers, having a well maintained office area is essential. Office space that is clean and tidy helps establish a positive image of the company. Imagine walking into an office that is filthy, disorganized and cluttered. First impression is crucial to creating that image of quality and professionalism. That is why it is important to employee a professional service to maintain the aesthetic qualities of your company. Competent companies that specialize in office cleaning services to fill the needs of your company are easy to find. In terms of interest and principal balance, would you want to know how your lender comes up with what portion of every amount is paid on your mortgage each month? They frequently utilize a table that details each periodic payment on your mortgage. Enter the amortization schedule.

In terms of interest and principal balance, would you want to know how your lender comes up with what portion of every amount is paid on your mortgage each month? They frequently utilize a table that details each periodic payment on your mortgage. Enter the amortization schedule. A clean and ordered employment atmosphere is fundamental to boost productiveness. How would your clients react if they strolled into your office to find piles of paperwork in all quarters, soiled carpets and disorganised desks?

A clean and ordered employment atmosphere is fundamental to boost productiveness. How would your clients react if they strolled into your office to find piles of paperwork in all quarters, soiled carpets and disorganised desks? Order excessive safety business checks online from Costco Checks. Supplying your organization with customized, excessive-high quality checks is without doubt one of the smartest issues that a enterprise owner can do. At , we make it straightforward and affordable to get all you’ll ever need, together with laptop checks, one write checks, three to-a-page checks, and even deposit slips.

Order excessive safety business checks online from Costco Checks. Supplying your organization with customized, excessive-high quality checks is without doubt one of the smartest issues that a enterprise owner can do. At , we make it straightforward and affordable to get all you’ll ever need, together with laptop checks, one write checks, three to-a-page checks, and even deposit slips.

…

… So you have decided that hiring a professional office cleaning company is a more reliable, effective, and efficient manner of maintaining the cleanliness and sanitation of your offices. You are not alone. Property management companies, facilities directors, and office managers for large and small companies depend on professional office cleaners to maintain a clean and sanitary office. Unfortunately, in any given city there are likely several reputable companies that offer first class cleaning services, so how do you go about picking a professional office cleaning company that meets your needs? After all, you want to make sure that you hire a company that has the necessary skills and knowledge to maintain your offices so that you can present the best first impression to potential clients and even employees.

So you have decided that hiring a professional office cleaning company is a more reliable, effective, and efficient manner of maintaining the cleanliness and sanitation of your offices. You are not alone. Property management companies, facilities directors, and office managers for large and small companies depend on professional office cleaners to maintain a clean and sanitary office. Unfortunately, in any given city there are likely several reputable companies that offer first class cleaning services, so how do you go about picking a professional office cleaning company that meets your needs? After all, you want to make sure that you hire a company that has the necessary skills and knowledge to maintain your offices so that you can present the best first impression to potential clients and even employees. There is a list of great reasons to start an office cleaning business. For anyone hoping to be self-employed and manage their own work life, cleaning may be the best choice for a startup company. The cleaning business is a competitive market and the number of establishments that need the services demands a large work force. This environment makes the field a great one in which to be an entrepreneur.

There is a list of great reasons to start an office cleaning business. For anyone hoping to be self-employed and manage their own work life, cleaning may be the best choice for a startup company. The cleaning business is a competitive market and the number of establishments that need the services demands a large work force. This environment makes the field a great one in which to be an entrepreneur. Order excessive safety business checks on-line from Costco Checks. Manual checks are handy easy to use and are available a variety of styles. Save money in your Deluxe checks, and get the very best quality there may be. All of our customer support representatives prepare for 200 hours on our laser test products and order entry system, giving them a whole understanding of what we provide and methods to reply questions of our customers.

Order excessive safety business checks on-line from Costco Checks. Manual checks are handy easy to use and are available a variety of styles. Save money in your Deluxe checks, and get the very best quality there may be. All of our customer support representatives prepare for 200 hours on our laser test products and order entry system, giving them a whole understanding of what we provide and methods to reply questions of our customers.

Many people at one time or the other need money for a business, a project or even to help clear outstanding debts. There are many areas where you can access funding. It is necessary that you carefully look at the options available to you and choose what suits your situation best. You can look for financing from friends and family. The advantage of this type of arrangement is that usually there are no additional interest rates or hidden fees. However, it is important that you put it down in writing because many of these relationships have gone sour because of money.

Many people at one time or the other need money for a business, a project or even to help clear outstanding debts. There are many areas where you can access funding. It is necessary that you carefully look at the options available to you and choose what suits your situation best. You can look for financing from friends and family. The advantage of this type of arrangement is that usually there are no additional interest rates or hidden fees. However, it is important that you put it down in writing because many of these relationships have gone sour because of money. It is important that an office always looks good. Not only does this mean that you are able to work to a higher standard and more efficiently, but it also means that it gives a good impression to anybody that visits your company. Unfortunately, it can be quite costly to hire a company to clean your office, but it is just something that is required. This page will help you to consider how you could go about hiring the perfect company for your needs.

It is important that an office always looks good. Not only does this mean that you are able to work to a higher standard and more efficiently, but it also means that it gives a good impression to anybody that visits your company. Unfortunately, it can be quite costly to hire a company to clean your office, but it is just something that is required. This page will help you to consider how you could go about hiring the perfect company for your needs. Regardless of how rewarding your full-time job could also be, finding the right side business ideas and ultimately becoming absolutely self-employed is much more meaningful than nice pay and strong advantages. Looking on the right way to begin a small business but do not have a lot money? If you wish to start a enterprise within the household segment you can start gross sales and repair of Geyser. On top of just renting on Airbnb, you can take this business idea to the following degree by providing your guests add-on and personalized experiences for an extra charge.

Regardless of how rewarding your full-time job could also be, finding the right side business ideas and ultimately becoming absolutely self-employed is much more meaningful than nice pay and strong advantages. Looking on the right way to begin a small business but do not have a lot money? If you wish to start a enterprise within the household segment you can start gross sales and repair of Geyser. On top of just renting on Airbnb, you can take this business idea to the following degree by providing your guests add-on and personalized experiences for an extra charge.

A lot of different ingredients turn up in recipes for natural cleaning products. And you’ve got to wonder whether some of them are all that natural or not. “Natural” is a bit of an ambiguous term that isn’t really clarified. It certainly doesn’t mean “organic” or “of vegetable origin”. Not all “natural” cleaners are organic (e.g. baking soda, which is mined) or of vegetable origin (e.g. soap, which often contains animal fats (tallow)).

A lot of different ingredients turn up in recipes for natural cleaning products. And you’ve got to wonder whether some of them are all that natural or not. “Natural” is a bit of an ambiguous term that isn’t really clarified. It certainly doesn’t mean “organic” or “of vegetable origin”. Not all “natural” cleaners are organic (e.g. baking soda, which is mined) or of vegetable origin (e.g. soap, which often contains animal fats (tallow)).

Into the life of every cleaning business owner, a little extra, helpful knowledge will fall.

Into the life of every cleaning business owner, a little extra, helpful knowledge will fall. Begin an online business as we speak! Naturally, it helps if you already have an online audience you may tap for listening to your common podcast (like I did), however that hasn’t stopped thousands of individuals from building profitable facet enterprise concepts into lucrative podcasts—together with Alex Blumberg, founding father of Gimlet Media who teaches how you can use storytelling and launch a podcast You can too take a look at this class from podcaster and entrepreneur, Lewis Howes, about the right way to make money podcasting as a facet business idea, which repeatedly broadcasts without cost on CreativeLive.

Begin an online business as we speak! Naturally, it helps if you already have an online audience you may tap for listening to your common podcast (like I did), however that hasn’t stopped thousands of individuals from building profitable facet enterprise concepts into lucrative podcasts—together with Alex Blumberg, founding father of Gimlet Media who teaches how you can use storytelling and launch a podcast You can too take a look at this class from podcaster and entrepreneur, Lewis Howes, about the right way to make money podcasting as a facet business idea, which repeatedly broadcasts without cost on CreativeLive.

The overall condition of your office is important for making a positive first impression for clients and staff members alike. Moreover, a clean and well-organized office is much more conducive to productivity as employees can focus on the important tasks at hand rather than maintaining the cleanliness of their workspaces. A professional office cleaning company is contracted to provide customized cleaning services so that your offices are always clean, comfortable, and presentable. Yet, many business owners choose not to hire professionals and instead rely on current employees to maintain the office. But while some business owners may feel the savings offered by not hiring a professional cleaner is reason enough to leave the task to current employees, the fact remains that there are many benefits of working with a professional office cleaning company.

The overall condition of your office is important for making a positive first impression for clients and staff members alike. Moreover, a clean and well-organized office is much more conducive to productivity as employees can focus on the important tasks at hand rather than maintaining the cleanliness of their workspaces. A professional office cleaning company is contracted to provide customized cleaning services so that your offices are always clean, comfortable, and presentable. Yet, many business owners choose not to hire professionals and instead rely on current employees to maintain the office. But while some business owners may feel the savings offered by not hiring a professional cleaner is reason enough to leave the task to current employees, the fact remains that there are many benefits of working with a professional office cleaning company. When selecting a business thought, focus on your strengths and skills. On the lookout for good enterprise ideas for youngsters to make money? Providing Disaster administration services is one other concept. Funding: Depending on the place you reside and the companies supplied, you might must receive a business license or be registered along with your state.

When selecting a business thought, focus on your strengths and skills. On the lookout for good enterprise ideas for youngsters to make money? Providing Disaster administration services is one other concept. Funding: Depending on the place you reside and the companies supplied, you might must receive a business license or be registered along with your state.

Early attention to any overspending and running out of money provides a great opportunity to correct and prevent these habits from causing a serious expansion of personal debt and development of other financial problems.

Early attention to any overspending and running out of money provides a great opportunity to correct and prevent these habits from causing a serious expansion of personal debt and development of other financial problems. Order excessive safety business checks on-line from Costco Checks. Save on excessive safety business checks, deposit solutions, envelopes, address stamps, binders and more. At Vistaprint, you are receiving protected custom checks for incredible prices. Print checks from your home or workplace any time you want with customized pc checks.

Order excessive safety business checks on-line from Costco Checks. Save on excessive safety business checks, deposit solutions, envelopes, address stamps, binders and more. At Vistaprint, you are receiving protected custom checks for incredible prices. Print checks from your home or workplace any time you want with customized pc checks.

Your financial education is extremely important especially during this time of recession, because I believe that money affects not only our financial life but the other important aspects of our life as well… family, health, work, emotions, etc.

Your financial education is extremely important especially during this time of recession, because I believe that money affects not only our financial life but the other important aspects of our life as well… family, health, work, emotions, etc. Begin a web based enterprise as we speak! If you wish to step your Amazon selling game up, take a look at this detailed guide to Amazon and eBay retail arbitrage on Entrepreneur that includes an interview with Julie Becker and several drop-shippers who’ve grown this house based mostly business concept from aspect enterprise idea right into a lucrative money-maker.

Begin a web based enterprise as we speak! If you wish to step your Amazon selling game up, take a look at this detailed guide to Amazon and eBay retail arbitrage on Entrepreneur that includes an interview with Julie Becker and several drop-shippers who’ve grown this house based mostly business concept from aspect enterprise idea right into a lucrative money-maker.

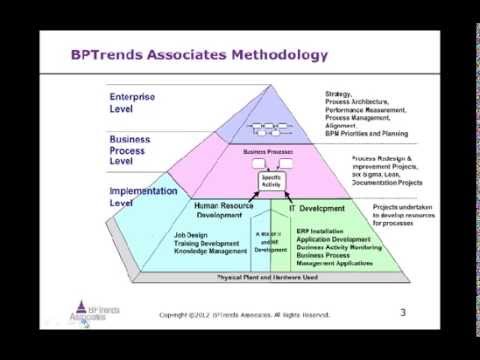

Analyzing the current market allows you to take a good look at your competitors and where you stand as a business within the market. Are you leading the market or are you far behind from being at the top? Business statistics allow you to see where you are with your product or service. This data not only gives you a ranking, but also allows you to determine what your strong points are and areas that need development and improvement. In addition, you will be able to see areas within the marketplace that are opportunities.

Analyzing the current market allows you to take a good look at your competitors and where you stand as a business within the market. Are you leading the market or are you far behind from being at the top? Business statistics allow you to see where you are with your product or service. This data not only gives you a ranking, but also allows you to determine what your strong points are and areas that need development and improvement. In addition, you will be able to see areas within the marketplace that are opportunities. Order high security business checks online from Costco Checks. Simply as necessary as personalization is the peace of mind you may expertise figuring out that your online business checks will likely be ordered safely. Choose from high security enterprise checks, desk checks, payroll checks and more in a wide range of sizes.

Order high security business checks online from Costco Checks. Simply as necessary as personalization is the peace of mind you may expertise figuring out that your online business checks will likely be ordered safely. Choose from high security enterprise checks, desk checks, payroll checks and more in a wide range of sizes.

In the modern times we live in today, most of the businesses we see everyday are looking for ways to increase their activity and productivity levels. To ensure that they make the maximum amount of profits out of their invested money, business owners employ a range of strategies that seldom provide fruitful results.

In the modern times we live in today, most of the businesses we see everyday are looking for ways to increase their activity and productivity levels. To ensure that they make the maximum amount of profits out of their invested money, business owners employ a range of strategies that seldom provide fruitful results.