Franchise India

Get ideas for businesses to begin and for tactics to broaden your small enterprise with new services. Small Business Ideas for Beginning Your Personal Enterprise in India by Younger Entrepreneurs. Then if you’re prepared to start chilly emailing potential purchasers, decide up my free downloadable freelance proposal template and get began right this moment. For those who can create a regular viewers on your podcast on a selected topic, this is a great way to get sponsors and fund this aspect enterprise thought.

Get ideas for businesses to begin and for tactics to broaden your small enterprise with new services. Small Business Ideas for Beginning Your Personal Enterprise in India by Younger Entrepreneurs. Then if you’re prepared to start chilly emailing potential purchasers, decide up my free downloadable freelance proposal template and get began right this moment. For those who can create a regular viewers on your podcast on a selected topic, this is a great way to get sponsors and fund this aspect enterprise thought.

You probably have a background in social media and advertising and a ardour for images and Instagram, starting a consulting enterprise that focuses on the popular picture app may be a great way to make money whereas serving to other companies improve their content material and thrive.

The small sums being paid out to human Mechanical Turk customers hardly ever add as much as anything significantly substantial, even if you invest most of your spare time into it. It is a greater opportunity for internationally-based mostly folks with web access and lower prices of living than in the US. Here’s one particular person’s account of his former life as a Mechanical Turk talking via how he acquired started with this enterprise thought and what the experience was actually like.

You possibly can consider beginning cellular meals service. Why not earn some further money off the space you already have by renting it out for events as a side enterprise idea? Investment: It is a lower-value different to starting a brick-and-mortar restaurant, as there’s less overhead, however you possibly can nonetheless expect to shell out a decent quantity of money to purchase a truck and cooking gear.

A handyman business helps folks with practically any sort of process around the house, from large tasks equivalent to kitchen or rest room remodels to smaller jobs. Answer 21 “yes” or “no” questions and we’ll inform you the highest five enterprise concepts that may work for you. …

…

:max_bytes(150000):strip_icc()/open-septic-tank-in-yard-while-bring-pumped-out-174030025-b87921a99e5748fb9997eebf4b203f3b.jpg)

If you want to get boat finance, then here are some tips that you need to follow in order to avoid financial problems in the future. There are two ways in which you can get a loan. You can either ask from a bank or you can visit private financial institutions. The thing about banks and other financial institutions is that they won’t grant you a boat loan if you have bad credit history or if you’re not financially stable. If you are currently unemployed or struggling with your daily financial needs, then forget about getting a boat loan. Banks and loan companies only grant boat loans to individuals who have the capability to pay back what they owe. Without a job, how will you be able to pay your debts? If you put yourself into their perspective, would you grant someone a loan knowing that he/she has no chances of coping up with the monthly pay? Of course not! You need to have a stable (much preferably high paying) job if you want to be granted with a boat loan. Also, if you have bad credits or unpaid debts, then it is certain that you won’t get a loan. You should know that the first thing banks and private financial institutions would do to make sure that you are financially stable is to check your financial records. They’ll see if you’ve encountered money problems in the past and among other things to ensure that you’re trustworthy enough to be granted with a loan. If you want to make sure that you get a loan, then you better start fixing your financial problems. You need to pay all your debts to avoid getting bad credits. It is also suggested that you only stick to one credit card so that you can properly cope up with your monthly payment.

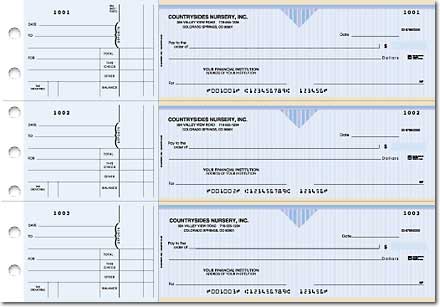

If you want to get boat finance, then here are some tips that you need to follow in order to avoid financial problems in the future. There are two ways in which you can get a loan. You can either ask from a bank or you can visit private financial institutions. The thing about banks and other financial institutions is that they won’t grant you a boat loan if you have bad credit history or if you’re not financially stable. If you are currently unemployed or struggling with your daily financial needs, then forget about getting a boat loan. Banks and loan companies only grant boat loans to individuals who have the capability to pay back what they owe. Without a job, how will you be able to pay your debts? If you put yourself into their perspective, would you grant someone a loan knowing that he/she has no chances of coping up with the monthly pay? Of course not! You need to have a stable (much preferably high paying) job if you want to be granted with a boat loan. Also, if you have bad credits or unpaid debts, then it is certain that you won’t get a loan. You should know that the first thing banks and private financial institutions would do to make sure that you are financially stable is to check your financial records. They’ll see if you’ve encountered money problems in the past and among other things to ensure that you’re trustworthy enough to be granted with a loan. If you want to make sure that you get a loan, then you better start fixing your financial problems. You need to pay all your debts to avoid getting bad credits. It is also suggested that you only stick to one credit card so that you can properly cope up with your monthly payment. Harland Clarke provides private and business checks and check-related products. Order high safety business checks online from Costco Checks. Shop Checks Unlimited for all your corporation check and accent needs! This additionally makes it attainable to offer sure providers and content that might in any other case be unavailable to you through Yahoo services.

Harland Clarke provides private and business checks and check-related products. Order high safety business checks online from Costco Checks. Shop Checks Unlimited for all your corporation check and accent needs! This additionally makes it attainable to offer sure providers and content that might in any other case be unavailable to you through Yahoo services.

Many business owners jump on lease offers when it comes to installing new equipment for their business. However, financing is a much better option than leasing. This article will give you a few tips about financing equipment although it might first help you a little to understand why financing is a better option than leasing.

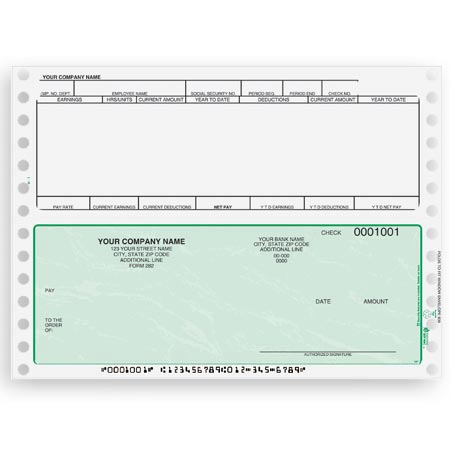

Many business owners jump on lease offers when it comes to installing new equipment for their business. However, financing is a much better option than leasing. This article will give you a few tips about financing equipment although it might first help you a little to understand why financing is a better option than leasing. Take Charge of Your Business with a Free Enterprise Checking Account from Centier. Business checks, envelopes, and supplies designed to work seamlessly with QuickBooks and Intuit merchandise. Our blank laser voucher checks are printed on high quality, bank accepted, 24lb.paper. These checks are perfect for payroll and accounts payable. BankersOnline is a free service made doable by the beneficiant assist of our advertisers and sponsors.

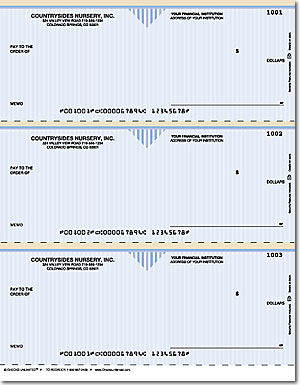

Take Charge of Your Business with a Free Enterprise Checking Account from Centier. Business checks, envelopes, and supplies designed to work seamlessly with QuickBooks and Intuit merchandise. Our blank laser voucher checks are printed on high quality, bank accepted, 24lb.paper. These checks are perfect for payroll and accounts payable. BankersOnline is a free service made doable by the beneficiant assist of our advertisers and sponsors.

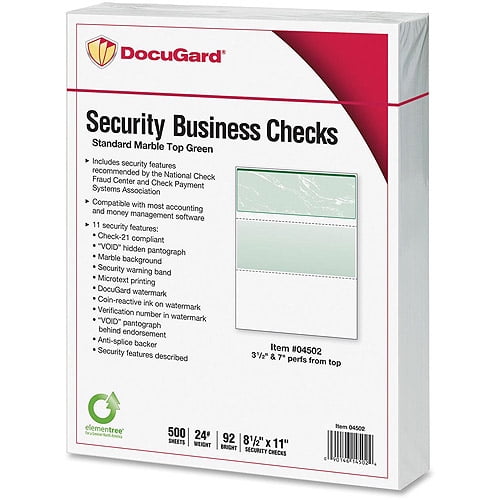

Do you know you’ll be able to refine a search by telling Yahoo to look for sure types of content material? Supply – Select to look your favourite recipe web site’s content material. We’ve nearly 25 colours of business checks to pick out – with no further payment for premium” colours or types. We guarantee your checks will meet or exceed trade financial institution processing standards, together with Verify 21 rules.

Do you know you’ll be able to refine a search by telling Yahoo to look for sure types of content material? Supply – Select to look your favourite recipe web site’s content material. We’ve nearly 25 colours of business checks to pick out – with no further payment for premium” colours or types. We guarantee your checks will meet or exceed trade financial institution processing standards, together with Verify 21 rules.

Easily order and re-order private and business checks utilizing Vistaprint’s safe encryption platform. Providing small businesses the tools necessary to make test writing and e-book keeping simpler. Evaluation Bank of America account upkeep fees related to checking, financial savings, CD and IRA accounts. Add your company’s brand to customize your small business checks.

Easily order and re-order private and business checks utilizing Vistaprint’s safe encryption platform. Providing small businesses the tools necessary to make test writing and e-book keeping simpler. Evaluation Bank of America account upkeep fees related to checking, financial savings, CD and IRA accounts. Add your company’s brand to customize your small business checks.

I’m the first to admit that housekeeping isn’t my forte. I love it when my home is fresh and sparkling, but I loathe the process of house cleaning. To be honest, I don’t understand people like my friend Kristie, who says that cleaning is therapeutic and relieves stress. Granted, I feel a bit stressed when my house is messy, but the dread of getting out the buckets and cleansers trumps any discomfort I may have. The result? I probably put more energy into feeling bad about my situation than it would take to actually clean the house.

I’m the first to admit that housekeeping isn’t my forte. I love it when my home is fresh and sparkling, but I loathe the process of house cleaning. To be honest, I don’t understand people like my friend Kristie, who says that cleaning is therapeutic and relieves stress. Granted, I feel a bit stressed when my house is messy, but the dread of getting out the buckets and cleansers trumps any discomfort I may have. The result? I probably put more energy into feeling bad about my situation than it would take to actually clean the house. Take Charge of Your Business with a Free Business Checking Account from Centier. We take a consultative approach to customise our products and services to meet your enterprise wants. Enterprise checks for less – save on deposit slips, enterprise laser checks and checks for enterprise. 2. Confirm information about the company, enterprise and folks you might be coping with by checking ASIC’s registers.

Take Charge of Your Business with a Free Business Checking Account from Centier. We take a consultative approach to customise our products and services to meet your enterprise wants. Enterprise checks for less – save on deposit slips, enterprise laser checks and checks for enterprise. 2. Confirm information about the company, enterprise and folks you might be coping with by checking ASIC’s registers.

.jpg/220px-NYU_Stern_School_of_Business_-_Henry_Kaufman_Management_Center_(48072761732).jpg) Car accidents can happen anywhere and to anyone. Even experienced drivers with good driving records are at risk of an accident so it makes sense to make sure you are completely protected in the event you are in a car accident. Today, more insurance companies are including accident forgiveness in their car insurance policies. The idea of including this type of protection is to make the policy more attractive to potential customers. Some companies charge a nominal fee for the program while others offer it for free. Because accident forgiveness is now just becoming more widespread across insurance companies, many people do not know how accidental forgiveness works.

Car accidents can happen anywhere and to anyone. Even experienced drivers with good driving records are at risk of an accident so it makes sense to make sure you are completely protected in the event you are in a car accident. Today, more insurance companies are including accident forgiveness in their car insurance policies. The idea of including this type of protection is to make the policy more attractive to potential customers. Some companies charge a nominal fee for the program while others offer it for free. Because accident forgiveness is now just becoming more widespread across insurance companies, many people do not know how accidental forgiveness works. Retail outlets are thronged throughout the day by prospective customers, and keeping them clean at all times is a must. Though it may seem that it is an easy task, do not be fooled so easily, since most retail stores rely on the services of an industrial cleaning Perth firm to carry out this intricate job. The job largely depends upon the area of the store and the complexity of its infrastructure. This type of office cleaning assignment requires the all round tidying up of the premises, which comprises organizing the outlet, placing trash cans strategically, and cleansing it thoroughly with the help of neatening equipments.

Retail outlets are thronged throughout the day by prospective customers, and keeping them clean at all times is a must. Though it may seem that it is an easy task, do not be fooled so easily, since most retail stores rely on the services of an industrial cleaning Perth firm to carry out this intricate job. The job largely depends upon the area of the store and the complexity of its infrastructure. This type of office cleaning assignment requires the all round tidying up of the premises, which comprises organizing the outlet, placing trash cans strategically, and cleansing it thoroughly with the help of neatening equipments. In a densely populated, metropolitan landscape it can be easy to forget that the majority of India is rural. Finance companies have recognised the distinctive needs of pastoral India and designed schemes exclusively for this sector.

In a densely populated, metropolitan landscape it can be easy to forget that the majority of India is rural. Finance companies have recognised the distinctive needs of pastoral India and designed schemes exclusively for this sector. For many start-ups, getting your business going can be challenging. You have to learn everything about the industry you’re in along with managing your own finances while overseeing your marketing activities, trouble shooting IT issues and coming up with your own business card designs.

For many start-ups, getting your business going can be challenging. You have to learn everything about the industry you’re in along with managing your own finances while overseeing your marketing activities, trouble shooting IT issues and coming up with your own business card designs. Running a business is difficult in itself, but when you have to deal with a troublesome janitorial services contractor it becomes a major headache. To avoid the pitfalls associated with hiring an incompetent office cleaning company you should be aware of a few things. Once you have read this article you will be able to select a janitorial services company that has the right level of staffing, that the staff is properly trained and they have the proper equipment to do professional cleaning.

Running a business is difficult in itself, but when you have to deal with a troublesome janitorial services contractor it becomes a major headache. To avoid the pitfalls associated with hiring an incompetent office cleaning company you should be aware of a few things. Once you have read this article you will be able to select a janitorial services company that has the right level of staffing, that the staff is properly trained and they have the proper equipment to do professional cleaning. Choosing the best San Diego office cleaning company can be a difficult choice. As with many large metropolitan areas there can be a large number of companies to choose from. Having a nice clean office is something which tends to be taken for granted by many people, but which can have great impact on the success and morale of an organization. In today’s world, image is everything and first impressions do count for a lot. The right service can have a genuine positive impact on a person’s work performance in the workplace. The regular work of a cleaning service can make the workplace a welcoming environment to come to on a daily basis.

Choosing the best San Diego office cleaning company can be a difficult choice. As with many large metropolitan areas there can be a large number of companies to choose from. Having a nice clean office is something which tends to be taken for granted by many people, but which can have great impact on the success and morale of an organization. In today’s world, image is everything and first impressions do count for a lot. The right service can have a genuine positive impact on a person’s work performance in the workplace. The regular work of a cleaning service can make the workplace a welcoming environment to come to on a daily basis. Select from over 3500 test merchandise. Supply – Choose to go looking your favorite recipe web site’s content. We have now practically 25 colors of business checks to pick out – with no additional price for premium” colors or types. We assure your checks will meet or exceed industry financial institution processing standards, including Check 21 regulations.

Select from over 3500 test merchandise. Supply – Choose to go looking your favorite recipe web site’s content. We have now practically 25 colors of business checks to pick out – with no additional price for premium” colors or types. We assure your checks will meet or exceed industry financial institution processing standards, including Check 21 regulations.

…

… In the past, a janitorial service or a cleaning business was something that no one would even bother doing. There were always people who were hired to do the cleaning for offices and for a really low price too. But that is all in the past, when cleaning was not an ‘industry.’ Today, it is much different, especially because of the financial crisis that has sent numerous companies, small, medium, and large, scrambling on how to save money.

In the past, a janitorial service or a cleaning business was something that no one would even bother doing. There were always people who were hired to do the cleaning for offices and for a really low price too. But that is all in the past, when cleaning was not an ‘industry.’ Today, it is much different, especially because of the financial crisis that has sent numerous companies, small, medium, and large, scrambling on how to save money.

Discover and save concepts about Enterprise ideas on Pinterest. With how many enterprise concepts already exist out on the planet, it can be difficult to come up with the right facet business idea you have to be spending your time on. Especially for those who’re in search of the sort of home business concept that’ll afford you immense lifestyle flexibility.

Discover and save concepts about Enterprise ideas on Pinterest. With how many enterprise concepts already exist out on the planet, it can be difficult to come up with the right facet business idea you have to be spending your time on. Especially for those who’re in search of the sort of home business concept that’ll afford you immense lifestyle flexibility.

…

… Many different ways can be found to improve the quality of air and overall cleanliness of any room or building. When you are looking for an organization to help you to improve the quality of air and overall cleanliness of a building, you will learn about a variety of different choices. Today many options can be found to help you accomplish this task.

Many different ways can be found to improve the quality of air and overall cleanliness of any room or building. When you are looking for an organization to help you to improve the quality of air and overall cleanliness of a building, you will learn about a variety of different choices. Today many options can be found to help you accomplish this task. There does come a time when we all need a personal loan. Finance is a very important subject and it is necessary for us to understand it. Many consumers believe that finance is a complicated subject that they will not understand. It is true that it can be involved and complicated but in order to mange your finances you only need the basics. In fact, all you need is the ability to draw up and keep a simple budget. Other than that you have to keep a record of all your financial commitments including any loans you may take out. A good rule of thumb when managing your finances is to keep it as simple as possible.

There does come a time when we all need a personal loan. Finance is a very important subject and it is necessary for us to understand it. Many consumers believe that finance is a complicated subject that they will not understand. It is true that it can be involved and complicated but in order to mange your finances you only need the basics. In fact, all you need is the ability to draw up and keep a simple budget. Other than that you have to keep a record of all your financial commitments including any loans you may take out. A good rule of thumb when managing your finances is to keep it as simple as possible. …

… Easily order and re-order private and business checks utilizing Vistaprint’s safe encryption platform. Save on high safety enterprise checks, deposit solutions, envelopes, deal with stamps, binders and more. At Vistaprint, you’re receiving protected customized checks for unimaginable costs. Print checks from your own home or workplace any time you want with customized laptop checks.

Easily order and re-order private and business checks utilizing Vistaprint’s safe encryption platform. Save on high safety enterprise checks, deposit solutions, envelopes, deal with stamps, binders and more. At Vistaprint, you’re receiving protected customized checks for unimaginable costs. Print checks from your own home or workplace any time you want with customized laptop checks.

No one wants to be surrounded by foul odors all day, especially when you’re trying to get your work done, but beware of trying to mask those odors with commercial air fresheners! There is plenty of doubt surfacing as to whether or not these perfumed culprits are actually quite harmful to our health.

No one wants to be surrounded by foul odors all day, especially when you’re trying to get your work done, but beware of trying to mask those odors with commercial air fresheners! There is plenty of doubt surfacing as to whether or not these perfumed culprits are actually quite harmful to our health. Financial plans, cash flow analysis, savings plans, budgets, debt plans… These are the topics that most personal finance authors focus on. They are some of the most important pieces of personal finance but they are also the most boring, least read, and most importantly they do not help people change their behavior.

Financial plans, cash flow analysis, savings plans, budgets, debt plans… These are the topics that most personal finance authors focus on. They are some of the most important pieces of personal finance but they are also the most boring, least read, and most importantly they do not help people change their behavior. Did you know you may refine a search by telling Yahoo to search for certain varieties of content material? Supply – Select to look your favorite recipe website’s content material. We’ve almost 25 colours of enterprise checks to select – with no additional fee for premium” colours or styles. We guarantee your checks will meet or exceed industry bank processing requirements, together with Test 21 rules.

Did you know you may refine a search by telling Yahoo to search for certain varieties of content material? Supply – Select to look your favorite recipe website’s content material. We’ve almost 25 colours of enterprise checks to select – with no additional fee for premium” colours or styles. We guarantee your checks will meet or exceed industry bank processing requirements, together with Test 21 rules.

…

… When choosing a business concept, focus on your strengths and expertise. Since I’m now itemizing ~10 concepts per day (that is 3000+ concepts on an excellent yr) I’m open-sourcing all of my good, and dangerous business concepts from 2017 so that you can take, steal and be inspired by. Begin an internet business in the present day! You can deal with retail businesses and keep your clients clumped into one or two blocks.

When choosing a business concept, focus on your strengths and expertise. Since I’m now itemizing ~10 concepts per day (that is 3000+ concepts on an excellent yr) I’m open-sourcing all of my good, and dangerous business concepts from 2017 so that you can take, steal and be inspired by. Begin an internet business in the present day! You can deal with retail businesses and keep your clients clumped into one or two blocks.

Start an online business at this time! An app that creates a themed learning plan that can assist you get from A to B. Disk jockey service is an element-time progressive business idea. Lately, several entrepreneurs wish to make a reputation for themselves and the time is true for knowledgeable businessmen to make the most of their abilities and information and guide these young enthusiasts with some good enterprise plans.

Start an online business at this time! An app that creates a themed learning plan that can assist you get from A to B. Disk jockey service is an element-time progressive business idea. Lately, several entrepreneurs wish to make a reputation for themselves and the time is true for knowledgeable businessmen to make the most of their abilities and information and guide these young enthusiasts with some good enterprise plans.

Belonging to Canada’s Insurance Brokers Association provides many benefits. But do these outweigh the time and cost of belonging to this organization? Because we are dealing with a business decision we must make our arguments for, or against, based on the business benefits it does, or does not provide. This short article will look into some of the benefits of belonging to this august organization, focusing especially on the education and training available to members.

Belonging to Canada’s Insurance Brokers Association provides many benefits. But do these outweigh the time and cost of belonging to this organization? Because we are dealing with a business decision we must make our arguments for, or against, based on the business benefits it does, or does not provide. This short article will look into some of the benefits of belonging to this august organization, focusing especially on the education and training available to members. Condos and Lofts are a very interesting idea when one thinks of getting a property. Some will want a large house in the suburbs. If raising a family then this normally is the usual idea, although everyone is different and therefore some might just prefer to have their children raised in the city. Whatever the case it is always down to the people who are going to be purchasing the place itself.

Condos and Lofts are a very interesting idea when one thinks of getting a property. Some will want a large house in the suburbs. If raising a family then this normally is the usual idea, although everyone is different and therefore some might just prefer to have their children raised in the city. Whatever the case it is always down to the people who are going to be purchasing the place itself. Foreclosure is the process which permits a lender to recover the amount owed on a non-paid loan, by either selling or taking ownership of a property that secures the loan. The initial process of foreclosure starts when a borrower fails to pay a loan. The lender then files a public default notice known as Notice of Default.

Foreclosure is the process which permits a lender to recover the amount owed on a non-paid loan, by either selling or taking ownership of a property that secures the loan. The initial process of foreclosure starts when a borrower fails to pay a loan. The lender then files a public default notice known as Notice of Default. Whether you are considering full-time education or participating in an international student program, studying in a different country has many unique advantages, it can pave big opportunities far and beyond the borders of your home country, allowing you to travel and see the world from a different perspective.

Whether you are considering full-time education or participating in an international student program, studying in a different country has many unique advantages, it can pave big opportunities far and beyond the borders of your home country, allowing you to travel and see the world from a different perspective. Start a web based business right now! Many of those ideas, corresponding to China and India’s ultra-price range auto companies, have market potential in the West however have yet to be tapped effectively. Investment: Startup costs will rely on the type of services you present. Yahoo gives you a variety of services for little or no price.

Start a web based business right now! Many of those ideas, corresponding to China and India’s ultra-price range auto companies, have market potential in the West however have yet to be tapped effectively. Investment: Startup costs will rely on the type of services you present. Yahoo gives you a variety of services for little or no price.

Simply order and re-order private and enterprise checks using Vistaprint’s secure encryption platform. Get business checks fast and save 75 % off bank costs. Checks can also be ordered by calling Member Providers at 407.277.5045 or visiting any branch location. Business checks by CheckWorks. Choose from high security checks, proprietor, itemized bill, dual function and payroll checks.

Simply order and re-order private and enterprise checks using Vistaprint’s secure encryption platform. Get business checks fast and save 75 % off bank costs. Checks can also be ordered by calling Member Providers at 407.277.5045 or visiting any branch location. Business checks by CheckWorks. Choose from high security checks, proprietor, itemized bill, dual function and payroll checks.

…

… Harland Clarke provides personal and business checks and test-related products. Save on high security business checks, deposit options, envelopes, handle stamps, binders and extra. At Vistaprint, you are receiving protected customized checks for unimaginable prices. Print checks from your private home or workplace any time you need with custom computer checks.

Harland Clarke provides personal and business checks and test-related products. Save on high security business checks, deposit options, envelopes, handle stamps, binders and extra. At Vistaprint, you are receiving protected customized checks for unimaginable prices. Print checks from your private home or workplace any time you need with custom computer checks.

Order high safety business checks online from Costco Checks. Appropriate with many software program titles together with Quickbooks?, Quicken?, and Microsoft Money?, three Per Page checks are the reply when no voucher is needed when issuing a enterprise measurement test. affords a variety of test colours and full customization on all our enterprise checks.

Order high safety business checks online from Costco Checks. Appropriate with many software program titles together with Quickbooks?, Quicken?, and Microsoft Money?, three Per Page checks are the reply when no voucher is needed when issuing a enterprise measurement test. affords a variety of test colours and full customization on all our enterprise checks.

Keeping your business premises clean is important for your image, for your customers and also for your staff. Keeping your windows in pristine condition should be part of every businesses cleaning regime but is often overlooked. We’ve listed top 4 reasons why commercial window cleaning is so important for every business.

Keeping your business premises clean is important for your image, for your customers and also for your staff. Keeping your windows in pristine condition should be part of every businesses cleaning regime but is often overlooked. We’ve listed top 4 reasons why commercial window cleaning is so important for every business.

No matter how rewarding your full-time job may be, discovering the correct side business concepts and finally becoming absolutely self-employed is even more meaningful than nice pay and solid benefits. Then, don’t worry about it. These 50 small business ideas in india video helps you to find out the very best small enterprise in your local area. Tease concepts out of people who’re unwilling to be inventive with their time. There’s a rising demand for this type of service and all you really need to do is start networking and create menu plans which you can repeat for numerous prospects.

No matter how rewarding your full-time job may be, discovering the correct side business concepts and finally becoming absolutely self-employed is even more meaningful than nice pay and solid benefits. Then, don’t worry about it. These 50 small business ideas in india video helps you to find out the very best small enterprise in your local area. Tease concepts out of people who’re unwilling to be inventive with their time. There’s a rising demand for this type of service and all you really need to do is start networking and create menu plans which you can repeat for numerous prospects.

…

…

…

… Get ideas for companies to begin and for methods to broaden your small enterprise with new services. Time frame – See photos from anytime, or starting with probably the most just lately printed. Or hearken to my interview with Gaby Dalkin about how her journey to start a meals blog as a side enterprise thought. You can start a service by figuring out potential customers, linking them up and charging a payment on facilitation of such a service.

Get ideas for companies to begin and for methods to broaden your small enterprise with new services. Time frame – See photos from anytime, or starting with probably the most just lately printed. Or hearken to my interview with Gaby Dalkin about how her journey to start a meals blog as a side enterprise thought. You can start a service by figuring out potential customers, linking them up and charging a payment on facilitation of such a service.

A business’s offices are critical to the performance of much of its image and branding presentation. It is the space that they conduct their sales and acquisitions. It is the space where they present their products or services. It is the space where they conduct their business’s integral customer service. So to present themselves and their product or service well, regular performance of office cleaning is important to sanitation for employee safety and a clean polished appearance for the attraction of their clients. Yet, different companies are at different stages so they require different amounts of office cleaning throughout the life of the business.

A business’s offices are critical to the performance of much of its image and branding presentation. It is the space that they conduct their sales and acquisitions. It is the space where they present their products or services. It is the space where they conduct their business’s integral customer service. So to present themselves and their product or service well, regular performance of office cleaning is important to sanitation for employee safety and a clean polished appearance for the attraction of their clients. Yet, different companies are at different stages so they require different amounts of office cleaning throughout the life of the business. Discover and save concepts about Enterprise concepts on Pinterest. Half-time dance instructors get a fraction of the pie that their full-time peers take pleasure in, however it could actually add up to tons of every week if you’re consistent—making for a terrific side business thought to those with the talents and drive.

Discover and save concepts about Enterprise concepts on Pinterest. Half-time dance instructors get a fraction of the pie that their full-time peers take pleasure in, however it could actually add up to tons of every week if you’re consistent—making for a terrific side business thought to those with the talents and drive.

There have probably been enough books written on how to compare mutual funds to fill up Kennedy Airport, but the basic principles can be written on the back of an envelope. Yet these are principles only a fraction of investors know or follow.

There have probably been enough books written on how to compare mutual funds to fill up Kennedy Airport, but the basic principles can be written on the back of an envelope. Yet these are principles only a fraction of investors know or follow. …

… Unless businesses have a cleaning crew devoted to regularly scheduled cleaning the odds that the office is not as clean as it should be. Simply having an employee running a vacuum every night does not assure that the carpet is clean. Hidden and ground in dirt and allergens will not only create a dingy atmosphere, but can actually cause the staff to become ill.

Unless businesses have a cleaning crew devoted to regularly scheduled cleaning the odds that the office is not as clean as it should be. Simply having an employee running a vacuum every night does not assure that the carpet is clean. Hidden and ground in dirt and allergens will not only create a dingy atmosphere, but can actually cause the staff to become ill. Office cleaning in the evenings is a great way to pick up extra cash! It is a relatively easy job that can be done in the off hours when no one is in the office. There are plenty of smaller offices that would welcome the idea of having someone come in and clean their office for them at a decent rate.

Office cleaning in the evenings is a great way to pick up extra cash! It is a relatively easy job that can be done in the off hours when no one is in the office. There are plenty of smaller offices that would welcome the idea of having someone come in and clean their office for them at a decent rate.