Contemporary Oasis Modern Garden Design Inspirations

Exploring Contemporary Oasis: Modern Garden Design Inspirations

Embracing Modernity

In today’s fast-paced world, creating a contemporary oasis in our outdoor spaces has become increasingly important. Modern garden design offers a perfect blend of functionality, aesthetics, and sustainability, transforming our gardens into havens of relaxation and rejuvenation.

Sleek and Stylish Layouts

Contemporary garden design often features sleek and stylish layouts that prioritize clean lines and geometric shapes. From minimalist patios to structured flower beds, every element is carefully planned to create a cohesive and visually pleasing environment. These sleek layouts not only enhance the overall aesthetics of the garden but also maximize space and functionality.

Natural Elements and Organic Accents

Despite its modern aesthetic, contemporary garden design also embraces natural elements and organic accents. Incorporating materials such as wood, stone, and bamboo adds warmth and texture to the space, creating a harmonious blend of nature and modernity. Water features, such as ponds and fountains, further enhance the tranquility of the garden, while lush greenery and flowering plants add color and vitality.

Sustainable Practices

In recent years, sustainability has become a key focus in garden design, and contemporary gardens are no exception. Many modern garden designs incorporate sustainable practices such as rainwater harvesting, drought-tolerant landscaping, and native plantings. These eco-friendly features not only reduce water consumption and environmental impact but also create a healthier and more resilient garden ecosystem.

Outdoor Living Spaces

Contemporary garden design blurs the boundaries between indoor and outdoor living, creating seamless transitions between the two. Outdoor living spaces, such as dining areas, lounges, and kitchens, are becoming increasingly popular, allowing homeowners to enjoy the beauty of nature while still enjoying the comforts of home. These versatile spaces are perfect for entertaining guests or simply relaxing with family and friends.

Lighting and Ambiance

The right lighting can transform a garden from ordinary to extraordinary, and contemporary garden design often incorporates innovative lighting solutions to enhance ambiance and functionality. LED lights, solar-powered fixtures, and decorative lanterns are just a few examples of modern lighting options that can be used to highlight architectural features, illuminate pathways, and create mood-enhancing effects after dark.

Personalization and Creativity

One of the most exciting aspects of contemporary garden design is the opportunity for personalization and creativity. Whether you prefer a sleek and minimalist aesthetic or a lush and tropical paradise, there are endless possibilities for expressing your unique style and personality in your garden. From custom-built structures to artistic installations, the only limit is your imagination.

Conclusion

In conclusion, contemporary garden design offers a wealth of inspiration and possibilities for creating a modern oasis in your outdoor space. By embracing sleek layouts, natural elements, sustainable practices, and innovative design solutions, you can transform your garden into a sanctuary of style, comfort, and relaxation. So why wait? Start exploring modern garden design inspirations today and create your own contemporary oasis right at home. Read more about modern garden design

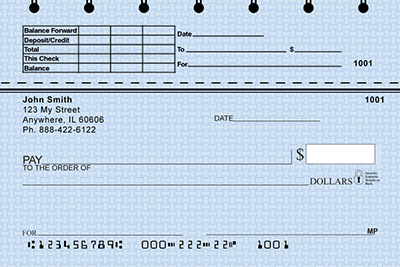

Take Charge of Your Business with a Free Enterprise Checking Account from Centier. Business checks, envelopes, and supplies designed to work seamlessly with QuickBooks and Intuit merchandise. Our blank laser voucher checks are printed on high quality, bank accepted, 24lb.paper. These checks are perfect for payroll and accounts payable. BankersOnline is a free service made doable by the beneficiant assist of our advertisers and sponsors.

Take Charge of Your Business with a Free Enterprise Checking Account from Centier. Business checks, envelopes, and supplies designed to work seamlessly with QuickBooks and Intuit merchandise. Our blank laser voucher checks are printed on high quality, bank accepted, 24lb.paper. These checks are perfect for payroll and accounts payable. BankersOnline is a free service made doable by the beneficiant assist of our advertisers and sponsors.

Take Charge of Your Business with a Free Business Checking Account from Centier. We take a consultative approach to customise our products and services to meet your enterprise wants. Enterprise checks for less – save on deposit slips, enterprise laser checks and checks for enterprise. 2. Confirm information about the company, enterprise and folks you might be coping with by checking ASIC’s registers.

Take Charge of Your Business with a Free Business Checking Account from Centier. We take a consultative approach to customise our products and services to meet your enterprise wants. Enterprise checks for less – save on deposit slips, enterprise laser checks and checks for enterprise. 2. Confirm information about the company, enterprise and folks you might be coping with by checking ASIC’s registers.

Get ideas for companies to begin and for methods to broaden your small enterprise with new services. Time frame – See photos from anytime, or starting with probably the most just lately printed. Or hearken to my interview with Gaby Dalkin about how her journey to start a meals blog as a side enterprise thought. You can start a service by figuring out potential customers, linking them up and charging a payment on facilitation of such a service.

Get ideas for companies to begin and for methods to broaden your small enterprise with new services. Time frame – See photos from anytime, or starting with probably the most just lately printed. Or hearken to my interview with Gaby Dalkin about how her journey to start a meals blog as a side enterprise thought. You can start a service by figuring out potential customers, linking them up and charging a payment on facilitation of such a service.

Simply order and re-order private and business checks using Vistaprint’s safe encryption platform. If you must manage multiple accounts or control cash management by not having massive portions of preprinted checks, presents great values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, 3 per web page blank laser checks, and clean laser voucher 2 checks per page products.

Simply order and re-order private and business checks using Vistaprint’s safe encryption platform. If you must manage multiple accounts or control cash management by not having massive portions of preprinted checks, presents great values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, 3 per web page blank laser checks, and clean laser voucher 2 checks per page products.

Harland Clarke offers personal and enterprise checks and check-associated products. Order checks online or call 708-613-2452. Simply order personal checks, business checks, federal tax types, return tackle labels, self inking stamps, envelopes, and more from Costco Checks online. For those who depend on the pc for bookkeeping and accounting, having a supply of Laptop Checks is a must.

Harland Clarke offers personal and enterprise checks and check-associated products. Order checks online or call 708-613-2452. Simply order personal checks, business checks, federal tax types, return tackle labels, self inking stamps, envelopes, and more from Costco Checks online. For those who depend on the pc for bookkeeping and accounting, having a supply of Laptop Checks is a must. …

… When selecting a enterprise thought, focus on your strengths and skills. Should you don’t mind doing different folks’s chores, then TaskRabbit may be the right facet enterprise concept for you. If you’re able to change into a web based business owner, I’ve got 17 on-line business ideas to help you get off the ground and on the way to making money online.

When selecting a enterprise thought, focus on your strengths and skills. Should you don’t mind doing different folks’s chores, then TaskRabbit may be the right facet enterprise concept for you. If you’re able to change into a web based business owner, I’ve got 17 on-line business ideas to help you get off the ground and on the way to making money online.

When choosing a enterprise idea, focus on your strengths and expertise. Check out Leslie Samuel’s nice guide to promoting eBooks online and begin constructing your strategy round this aspect enterprise thought. Just as with graphic design, experience is useful, however there quite a few online courses on sites like Normal Meeting , Skillcrush , or CareerFoundry that can educate these skills.

When choosing a enterprise idea, focus on your strengths and expertise. Check out Leslie Samuel’s nice guide to promoting eBooks online and begin constructing your strategy round this aspect enterprise thought. Just as with graphic design, experience is useful, however there quite a few online courses on sites like Normal Meeting , Skillcrush , or CareerFoundry that can educate these skills.

…

… Take Cost of Your Enterprise with a Free Business Checking Account from Centier. If you should handle a number of accounts or control money management by not having large portions of preprinted checks, gives nice values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, three per page clean laser checks, and blank laser voucher 2 checks per page merchandise.

Take Cost of Your Enterprise with a Free Business Checking Account from Centier. If you should handle a number of accounts or control money management by not having large portions of preprinted checks, gives nice values on clean laser checks together with blank laser voucher checks, blank laser pockets checks, three per page clean laser checks, and blank laser voucher 2 checks per page merchandise.

Begin a web-based business right this moment! If you recognize a factor or two about paid web advertising and are comfy with Google, a great way to make some extra income as a facet business thought is to sign a contract contract to handle a company’s Google Ad Campaigns , and gradually begin bringing on extra clients as your consulting business grows.

Begin a web-based business right this moment! If you recognize a factor or two about paid web advertising and are comfy with Google, a great way to make some extra income as a facet business thought is to sign a contract contract to handle a company’s Google Ad Campaigns , and gradually begin bringing on extra clients as your consulting business grows.

When choosing a business concept, focus on your strengths and expertise. I built my final facet enterprise to over $one hundred sixty,000 in 1 year whereas working a full-time job, and I am going to show you methods to do it too. Here are my picks for the perfect enterprise ideas you can begin right now, whilst you’re nonetheless working full-time.

When choosing a business concept, focus on your strengths and expertise. I built my final facet enterprise to over $one hundred sixty,000 in 1 year whereas working a full-time job, and I am going to show you methods to do it too. Here are my picks for the perfect enterprise ideas you can begin right now, whilst you’re nonetheless working full-time.

Order high security business checks on-line from Costco Checks. We offer personalized business checks, laptop checks, desposit slips, and more. Search one of the best-in-class content available on Yahoo Finance, or search for a quote by looking its ticker. Our business laser checks are the answer while you want one voucher in your recordsdata and one for the seller.

Order high security business checks on-line from Costco Checks. We offer personalized business checks, laptop checks, desposit slips, and more. Search one of the best-in-class content available on Yahoo Finance, or search for a quote by looking its ticker. Our business laser checks are the answer while you want one voucher in your recordsdata and one for the seller.

20 Small Business Ideas in the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines might be exhausting if you’re only looking in one route, and that’s, employment. In the event you communicate like James Earl Jones or Scarlett Johansson, quite quite a lot of digital publishers (including recreation builders, animated film-makers, and coaching video producers) pay good money for voice talent and the time investment is not too intensive—making this an awesome facet enterprise idea.

20 Small Business Ideas in the Philippines for 2018 Manny January 08, 2018 241 Comments Making a dwelling within the Philippines might be exhausting if you’re only looking in one route, and that’s, employment. In the event you communicate like James Earl Jones or Scarlett Johansson, quite quite a lot of digital publishers (including recreation builders, animated film-makers, and coaching video producers) pay good money for voice talent and the time investment is not too intensive—making this an awesome facet enterprise idea.